|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

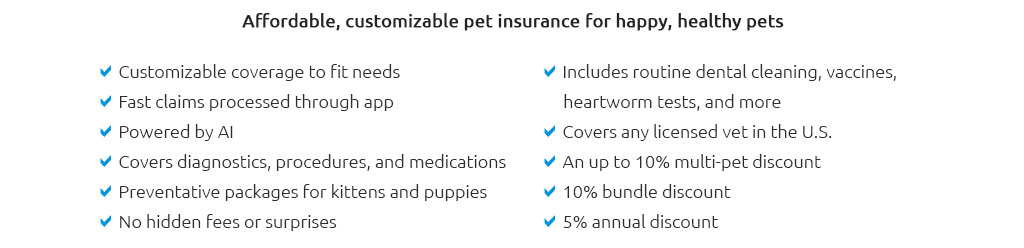

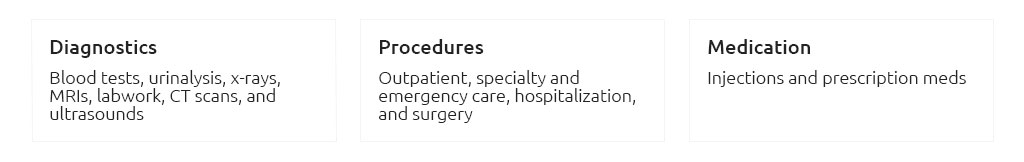

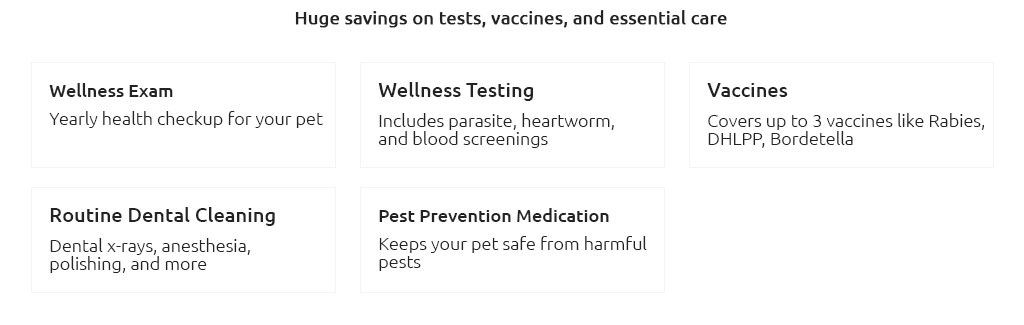

Compare Dog Health Insurance: A Comprehensive GuideIn today's world, the health and well-being of our canine companions are paramount. As veterinary care advances, so too does the complexity and cost of medical treatments. Enter dog health insurance, a resource that provides pet owners with financial peace of mind. However, with myriad options available, how does one choose the best policy? This article delves into the intricacies of comparing dog health insurance, offering insights into how these policies work, what they cover, and tips for selecting the right one for your furry friend. Dog health insurance is akin to human health insurance, designed to cover unforeseen medical expenses. Policies typically include coverage for accidents, illnesses, and sometimes wellness checks, though the extent of coverage can vary significantly between providers. When comparing plans, it's essential to consider factors such as premium costs, deductibles, reimbursement levels, and coverage limits. Some policies might boast lower monthly premiums but come with high deductibles, meaning you pay more out-of-pocket before the insurance kicks in. Conversely, plans with higher premiums often have lower deductibles and more comprehensive coverage, including hereditary and congenital conditions. Another crucial aspect to evaluate is the reimbursement model. Most insurers reimburse a percentage of the vet bill, typically ranging from 70% to 90%. It's wise to scrutinize this feature, as higher reimbursement rates can significantly reduce the financial burden in the event of expensive treatments. Additionally, some policies may offer unlimited lifetime benefits, while others impose annual or lifetime caps. If your dog is prone to certain health issues or is a breed known for specific genetic conditions, an unlimited policy might be more beneficial. When navigating the insurance landscape, pay attention to the exclusions and waiting periods. Pre-existing conditions are generally not covered, and some insurers have waiting periods for specific illnesses or conditions. Therefore, it's advisable to enroll your pet while they are young and healthy to maximize benefits. Furthermore, consider the insurer's reputation and customer service. A provider with excellent reviews and responsive customer support can make a significant difference in your experience when filing a claim.

In conclusion, comparing dog health insurance requires a thoughtful approach, balancing cost, coverage, and peace of mind. A well-chosen policy not only safeguards your pet's health but also your financial stability. FAQ SectionWhat does dog health insurance typically cover? Dog health insurance usually covers accidents and illnesses, and some plans may include wellness checks and preventive care. It's important to review each policy's details to understand the specific coverage provided. How do I determine the right coverage level for my dog? Consider factors such as your dog's breed, age, and health history. Breeds prone to certain genetic conditions may benefit from more comprehensive coverage. Assess your financial situation and risk tolerance to decide on the appropriate reimbursement rate and coverage limits. Are pre-existing conditions covered by dog health insurance? No, pre-existing conditions are typically excluded from coverage. It's advisable to enroll your dog in a health insurance plan while they are young and healthy to avoid these exclusions. What should I look for in a dog health insurance provider? Look for providers with strong reputations and positive customer reviews. Consider their customer service quality, claim processing times, and transparency in policy details. A provider that offers flexible plans and optional add-ons can be beneficial in meeting your pet's specific needs. https://thepetdoctorinc.com/wp-content/uploads/2019/04/veterinary-pet-insurance-comparison-chart-printable.pdf

What makes a pet insurance plan great? We asked the companies that questionthen asked the whole field. Comparing pet insurance for you, your veterinary team or ... https://www.petinsurancereview.com/dog-insurance

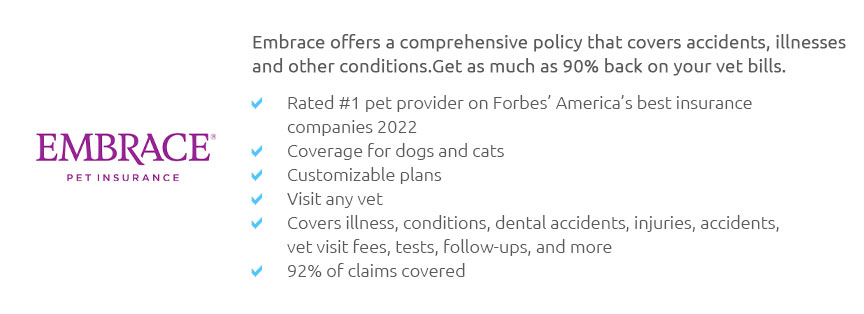

Embrace Best for Superior Benefits; Spot Best for Annual Coverage Choices; Pumpkin Best for Senior Dog and Senior Cat Coverage; Figo Best for Short ... https://www.petinsurancereview.com/

We are an affiliate site that allows users to browse, compare and read reviews from the top pet insurance providers.

|